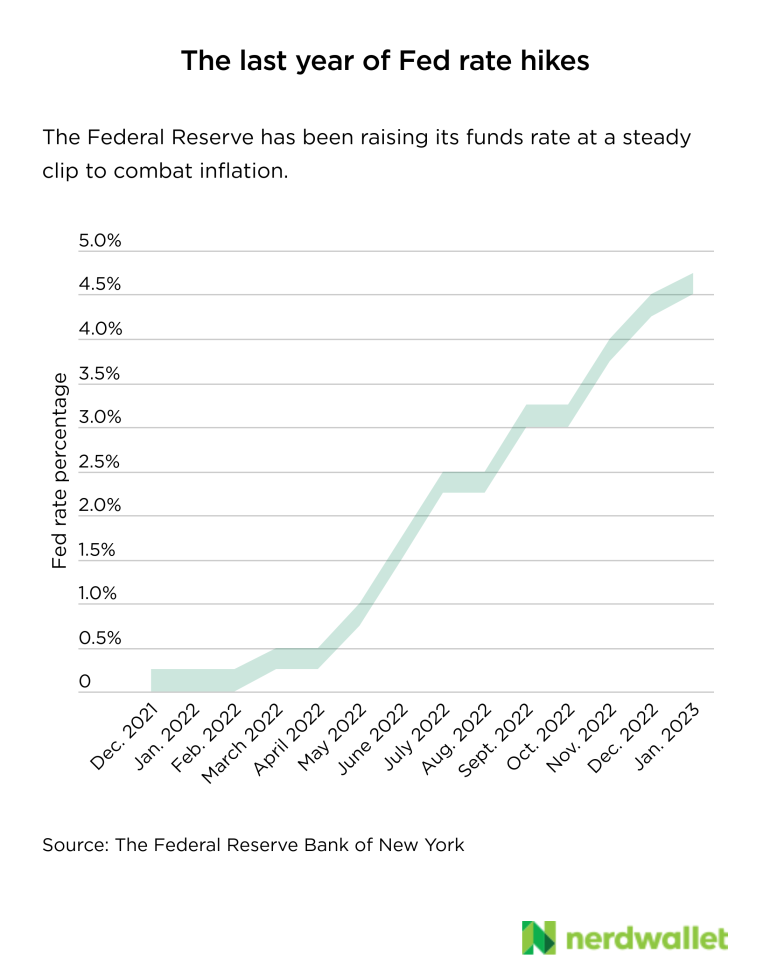

It’s 2023 and the Federal Reserve simply introduced a federal funds fee vary enhance of 0.25%. This is after seven fee will increase in 2022. This enhance brings the goal funds fee vary as much as 4.5%-4.75%. This enhance is smaller than a few of the steep modifications in 2022, however one other enhance means charges are at their highest level since 2007, which was the final time the goal hit 4.75%.

All of the current fee will increase imply loans and bank card balances are dearer. But when you have a financial savings account or certificates of deposit, you may gain advantage. Here’s a take a look at what the most recent fee enhance may imply for financial savings accounts in 2023.

Savings accounts: 3% APY or larger

In early 2022, a few of the greatest financial savings accounts earned a mere 0.50% annual proportion yield. Today, the most effective financial savings accounts earn greater than 3% APY, and some of the highest high-yield financial savings accounts are at 4% APY.

That’s a big soar for one yr. Since the newest Federal Reserve announcement states a smaller enhance in comparison with many of the 2022 fee bumps, don’t anticipate to see APYs which might be practically eight occasions larger. However, you should still see yields that edge a bit of larger, and extra accounts might attain the 4% determine.

Keep an eye fixed out for high-yield on-line financial savings accounts specifically, which have a tendency to supply a few of the highest charges.

On the opposite hand, financial savings accounts in a number of of the most important nationwide banks have charges which might be 0.01%, regardless of the a number of federal fund fee will increase final yr. These charges lag behind the nationwide common financial savings fee, which is 0.33% as of January 17, 2023, in accordance with the Federal Deposit Insurance Corp.

If you might have a financial savings account with a subpar fee, it may very well be price your effort to buy round for a financial savings account that earns 3%-4% APY.

Shore up financial savings for the long run

One of the explanations the Federal Reserve has been growing charges is that it desires to struggle inflation. Efforts from final yr appear to be working. According to the U.S. Bureau of Labor Statistics, the patron worth index, which is commonly used as a measure of inflation, elevated 6.5% yr over yr in December 2022. That determine, whereas comparatively excessive in comparison with earlier years, is decrease than it was earlier that summer season, when the CPI was 9.1% yr over yr in June 2022. If inflation falls throughout the Federal Reserve goal vary within the coming months, fee will increase might finish.

That’s all of the extra purpose to construct up an emergency fund in a high-yield account now. No one can predict the long run, however having a powerful financial savings account might help put together you to climate a monetary storm.

It’s very best to have three to 6 months’ price of your bills in financial savings, however that’s so much. If you don’t have that a lot saved up simply but, you may construct it up over time in quantities which might be possible for you.

Say you obtain a paycheck twice a month and are in a position to put away $50 every payday. You’ll have greater than $600 saved up inside six months, and that may assist in a monetary emergency. Putting that money in an account with a excessive fee might help you develop your funds.

The distinction a high-yield financial savings account makes

Where you retain your financial savings can impact your steadiness. If you set your emergency fund of $600 in an account with a 0.01% APY like that supplied by lots of the largest nationwide banks, and also you didn’t make any extra deposits, it will earn a complete of solely 6 cents after a yr. But if that cash was in a high-yield financial savings account that earns a 4.00% APY, even in case you didn’t make any extra deposits, the steadiness would develop by greater than $24 in that very same time interval. That’s a acquire for merely selecting a greater financial savings account.

You can attempt your personal calculations with NerdWallet’s financial savings calculator to see what your financial savings may earn.

Fed fee will increase are persevering with into 2023 — thus far. Take benefit by storing your cash in a high-yield financial savings account. You’ll earn higher charges than with a common financial savings account, and you’ll be higher ready for no matter monetary conditions come your means.

More From NerdWallet

Margarette Burnette writes for NerdWallet. Email: [email protected]. Twitter: @Margarette.

Source: www.bostonherald.com”