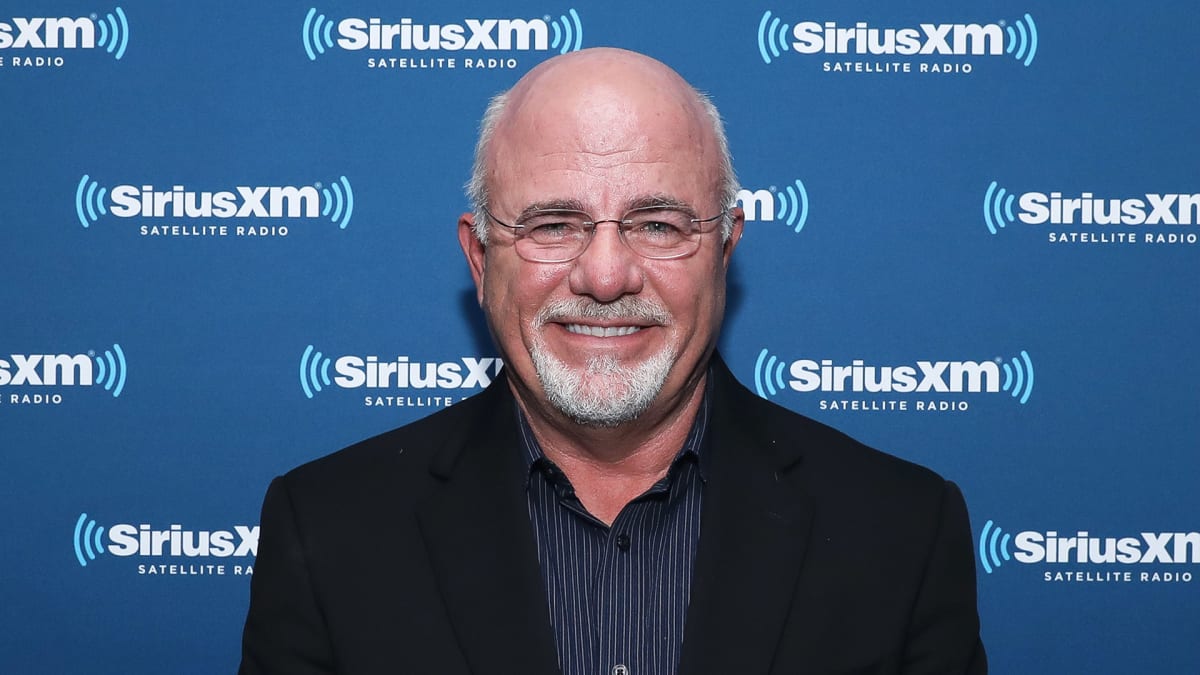

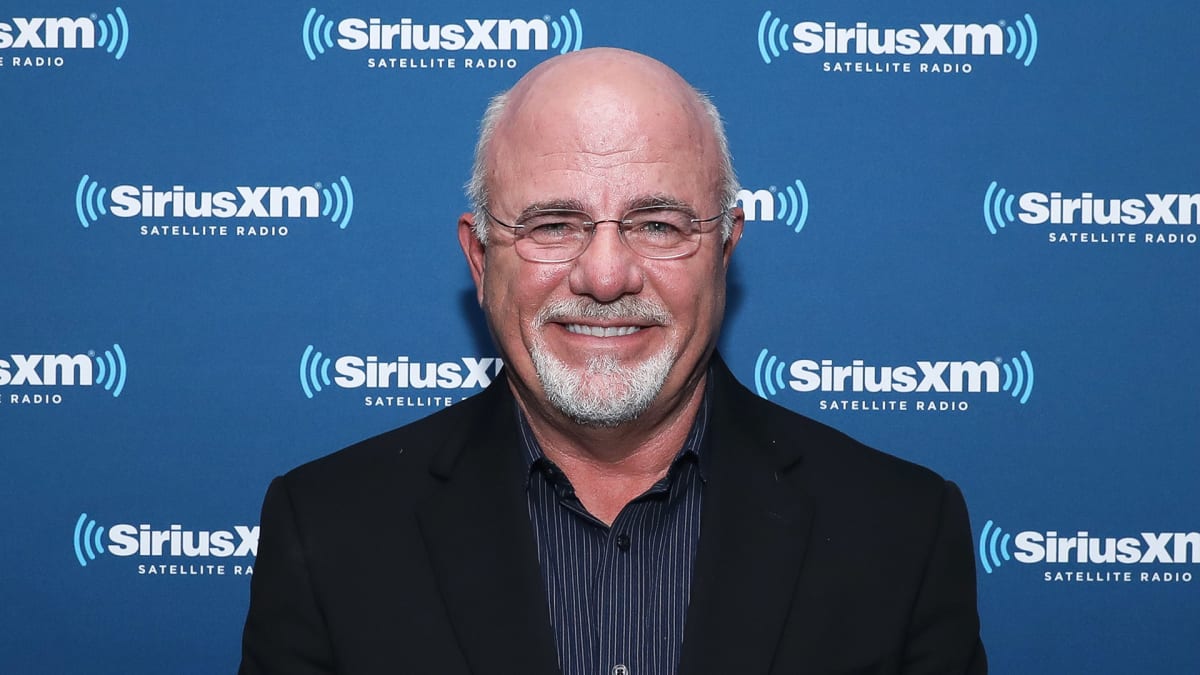

Radio host and writer Dave Ramsey frequently presents recommendation to folks in search of assist making an attempt to get their private funds so as.

In normal, folks ask him for solutions to particular and discrete iterations of difficulties that adhere to related broad themes. Ramsey, in most conditions, has a ready define, detailing his recommendations for achievement, that captures the wants of advice-seekers.

DON’T MISS: Dave Ramsey Confronts Controversy Over Parents Charging Kids for Rent

Ramsey has written a number of books and hosts a radio present the place he addresses various these monetary challenges.

He can also be energetic on Twitter. The tweets Ramsey posts are instructive for folks in search of private finance solutions as properly. They provide various levels of recommendation from the concrete to the summary — and even the philosophical. Some latest tweets are posted beneath.

For instance, Ramsey has a clear-cut checklist of issues each potential homebuyer ought to deal with earlier than making the acquisition.

Ramsey suggests boiling down how people can turn into rich into 5 normal gadgets.

Regarding spending, Ramsey presents some sensible recommendation on conserving it in verify.

In a philosophical assertion, he presents an alternate manner of taking a look at cash errors folks make.

There is a few context for this. Ramsey emphasizes getting out of debt as a recurring theme for a purpose.

He had a internet value of over one million {dollars} by age 26, however misplaced every little thing because of short-term debt and filed for chapter, in line with Ramsey Solutions. He then turned his failure right into a multi-million greenback firm.

The subsequent tweet provides one other piece of easy recommendation that appears to return from expertise.

In the next tweet, Ramsey advances this considering right into a suggestion for individuals who discover themselves wanting past their means, considering happiness lies elsewhere.

He advises not forgetting to benefit from the journey on the street to success.

Along these strains, Ramsey believes that discovering satisfaction with work, along with one’s private life, could also be a matter of selecting the suitable profession that gives rewarding experiences.

In addition to those recommendations for dwelling a fruitful life, personally and financially, Ramsey additionally presents some ideas about how to consider success and failure concerning wins and losses within the inventory market.

Ramsey says folks can react in unnecessarily damaging methods to short-term monetary losses. He attributes this to a human tendency to be extra dramatic than warranted when going through some difficult circumstances.

In truth, Ramsey goes so far as to name this impulse a “drama queen” inclination.

“Studies have shown us it takes $3 of gain in an investment to emotionally offset $1 of loss,” he just lately instructed somebody asking for some recommendation. “Our brains record negative things at a much greater rate than they do positive things, and it takes a lot of emotion to recover from that.”

“Your investments may be down a little,” Ramsey continued. “If you’ve got $1 million in there, it may be worth $900,000 right now. Next year, it’s liable to bounce up to $1.1 million. In other words, your entire retirement savings is not ‘eroding away.'”

Get unique entry to portfolio managers and their confirmed investing methods with Real Money Pro. Get began now.

Source: www.thestreet.com”