A supply particular person drops off pizzas at Silicon Valley Banks headquarters in Santa Clara, California on March 10, 2023.

Noah Berger | AFP | Getty Images

Silicon Valley Bank had exclusivity clauses with a few of its purchasers, limiting their capability to faucet banking providers from different establishments, SEC filings present.

The contracts, which made it not possible for these purchasers to securely diversify the place they saved their cash, assorted in language and scope. CNBC has reviewed six agreements that firms signed with SVB concerning financing or credit score options. All required the businesses to open or preserve financial institution accounts with SVB and use the agency for all or most of their banking providers.

Those preparations are notably problematic now that SVB has been seized by federal regulators after final week’s run on the financial institution. The Federal Deposit Insurance Corporation solely insures as much as $250,000 in deposits for every consumer, leaving SVB’s buyer base, which is closely concentrated in tech startups, fearful that tens of millions of {dollars} in working funds could be locked up for an indefinite time frame.

Banking regulators devised a plan Sunday to backstop depositors with cash at SVB to attempt to stem a feared panic throughout the business after the second-biggest financial institution failure in U.S. historical past.

In this photograph illustration an Upstart Holdings brand is seen on a smartphone display.

Pavlo Gonchar | SOPA Images | LightRocket | Getty Images

As a part of a multi-million greenback financing settlement with online-lending platform Upstart Holdings, SVB required that the corporate preserve all of its “operating and other deposit accounts, the Cash Collateral Account and securities/investment accounts” with SVB.

The contract made sure allowances for accounts at different banks, however set strict limits on their dimension.

“We haven’t had the exclusivity obligation for years and more than 90% of our cash is held at top five US banks,” Upstart mentioned in an announcement to CNBC.

Cloud software program vendor DocuSign additionally had an exclusivity contract with SVB, filings present, requiring that the e-signature firm maintain its “primary” depository, working, and securities accounts with the financial institution. That covenant was a part of a senior secured credit score facility between DocuSign and SVB dated May 2015. DocuSign was allowed to maintain present deposit accounts that have been held at Wells Fargo.

Upstart held its IPO in 2020, two years after DocuSign’s debut.

SVB offered a multi-million greenback mortgage to Sprout Social, which went public in 2019. The financial institution required that the social media administration software program firm preserve all of its “primary operating and other deposit accounts, the Cash Collateral Account and securities/investment accounts” with SVB.

As with Upstart, SVB set strict limits on the worth and sort of accounts that Sprout might maintain elsewhere.

In one other mortgage and safety settlement with Limelight Networks, which turned Edgio, SVB required that the corporate equally preserve all “operating accounts, depository accounts, and excess cash with Bank and Bank’s Affiliates.”

The contract included an exception for worldwide financial institution accounts however required that Limelight use solely SVB’s enterprise bank cards.

Founded 40 years in the past, SVB grew to develop into the sixteenth largest U.S. financial institution by property and a significant enterprise debt supplier, supporting firms of their infancy and offering the kind of liquidity that startups could not get from most conventional banks.

SVB did not instantly reply to a request for remark.

Dexcom signed a mortgage and safety settlement with SVB, requiring the maker of merchandise for managing diabetes to keep up its accounts on the financial institution and to switch money held elsewhere inside 90 days of the contract.

Dexcom’s settlement with SVB additionally required the corporate to open a lockbox and preserve the “majority” of the corporate’s securities accounts with the financial institution.

Also inside the health-tech market, SVB had an exclusivity contract with Hyperion Therapeutics, a drugmaker that was acquired in 2015 for $1.1 billion by Horizon Pharma.

Hyperion was required to financial institution solely with SVB, however notably didn’t have to offer the agency management over any accounts it used for “payroll, payroll taxes, and other employee wage and benefit payments.”

Representatives from DocuSign, Sprout Social, Edgio, Dexcom and Horizon did not instantly reply to requests for remark.

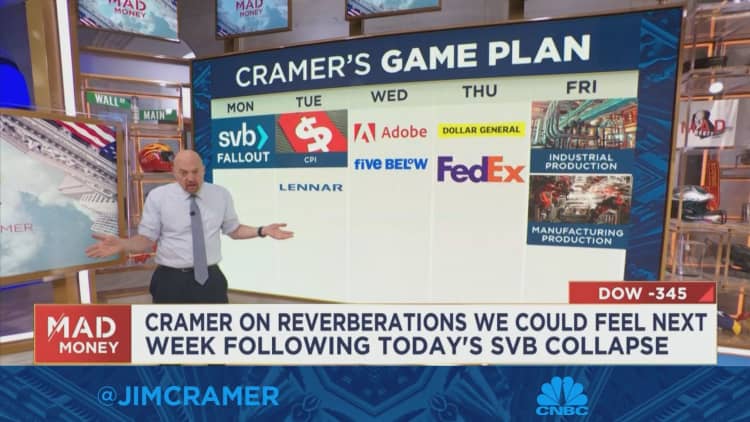

WATCH: Cramer on SVB’s collapse

Source: www.cnbc.com”