Just a few months into her divorce proceedings, Sarita thought it was suspicious that her partner, who earned $3 million yearly, did not have many property. After spending half a yr on discovery and enlisting the assistance of a forensic accountant, the New York housewife finally tracked down 12 bitcoins — then value half one million {dollars} — in a beforehand undisclosed crypto pockets.

Sarita, who was married for a decade and requested to make use of a pseudonym to guard herself from retaliation, stated she felt blindsided by her husband’s cryptocurrency funding.

associated investing information

“I know of bitcoin and things like that. I just didn’t know much about it,” Sarita stated. “It was never even a thought in my mind, because it’s not like we were discussing it or making investments together. … It was definitely a shock.”

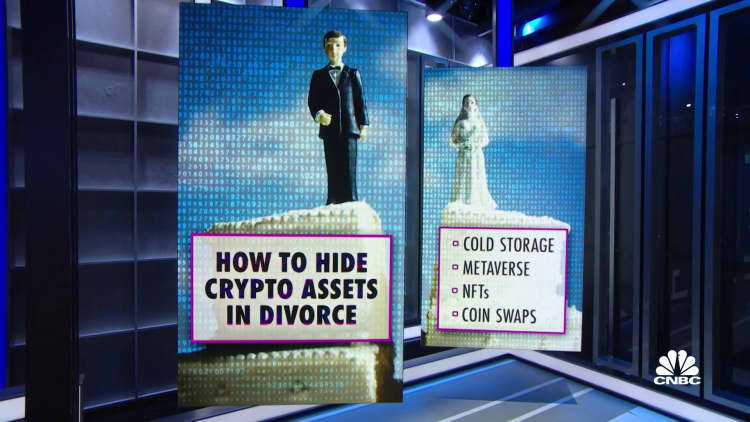

The world of monetary infidelity has develop into more and more refined, as buyers “hop” cash throughout blockchains and sink their money into metaverse properties. An NBC News ballot discovered that 1 in 5 Americans have invested in, traded or used cryptocurrency, with males between the ages of 18 and 49 accounting for the best share of all demographic teams.

CNBC spoke with divorce attorneys from Florida, New York, Texas and California, blockchain forensic investigators, monetary advisors, in addition to spouses who had been both searching down digital cash or the crypto holders themselves. Most agree that the legislation cannot sustain with all the brand new ways in which individuals earn and safeguard digital property that largely exist outdoors the attain of centralized intermediaries reminiscent of banks.

Family and marital legislation legal professional Kim Nutter stated she first dove into the crypto vernacular in 2015 however that the state of Florida, the place her follow is predicated, solely not too long ago inserted “cryptocurrency” into the usual request for manufacturing of paperwork — a key a part of establishing the couple’s marital property through the discovery course of.

“I really still think the law is trying to catch up with this novel form of currency, even though it’s been around for quite a while,” Nutter stated.

“What I find in litigation is because this is so new to all of us, even the most seasoned attorneys — unless you’re really going out of your way to study this — educating the court, knowing what to ask for, and finding the right experts, it’s much more of a scramble to me than other areas of law which had been around much longer,” she stated.

How crypto hunters monitor down cash

Hunting hidden crypto stashes in divorce has created a wholly new job class of forensic investigators. CNBC spoke with a number of of those crypto hunters, and so they say that whereas the blockchain is a public ledger, some spouses have develop into excellent at overlaying their monetary tracks.

“If you have a spouse that’s very tech savvy, and one that isn’t, it can be somewhat easy to hide those assets,” divorce legal professional Kelly Burris informed CNBC.

“The thing with cryptocurrency is it’s not regulated by any kind of centralized bank, so usually you can’t subpoena somebody and get documents and information related to somebody’s cryptocurrency holdings,” Burris stated. She stated she sees express cryptocurrency requests in discovery in 40% to 50% of her circumstances.

The Austin, Texas-based legal professional informed CNBC that the best solution to get data on a partner’s crypto holdings is to subpoena that data from a centralized crypto trade. Otherwise, the method typically includes a forensic evaluation of their pc or telephone to determine a pockets tackle after which a subsequent blockchain evaluation.

“Crypto asset forensics, cryptocurrency forensics, and blockchain forensics have become a significant part of our practice and by far, the fastest growing part of our practice,” stated Nick Himonidis, a New York-based forensic investigator.

Himonidis, who can also be a licensed personal investigator and a pc forensic skilled, estimates that 25% of his divorce-related circumstances contain some parts of cryptocurrency. Some of these circumstances, he stated, are easy and simple — conditions the place, for instance, a cryptocurrency reminiscent of bitcoin is a custodial asset held in a brokerage account or on a buying and selling platform reminiscent of Coinbase.

“These companies keep records just like your broker at Morgan Stanley would keep records of your trades,” he stated.

Other circumstances are what Himonidis describes because the “whole enchilada.”

“They’re calling us because they want to get us appointed as the neutral forensic cryptocurrency expert to marshal and account for the party’s crypto assets and track down any undisclosed crypto assets that one party may have,” he stated.

When Himonidis first received into searching crypto, it was all about bitcoin, ether and a handful of different cash. CoinMarketCap now lists greater than 24,000 cryptocurrencies, with a collective market cap of $1.1 trillion.

“There’s not just a couple of blockchains to worry about anymore. There’s hundreds and hundreds of coins out there on their own little independent blockchains,” he stated.

One of the core tenets of bitcoin is that its public ledger, which shops all token transactions in its historical past, is seen to everybody. But there’s a subset of cryptocurrencies referred to as privateness tokens, which have anonymity options constructed into them. Coins reminiscent of monero, sprint and zcash, which function on their very own blockchains, disguise virtually all transaction particulars, together with the identification of the sender and recipient, in addition to the transaction quantity. Himonidis stated it’s “virtually impossible” to hint and de-anonymize transactions in monero.

In one case, Himonidis discovered round $700,000 value of monero on a MacE-book that turned up in discovery.

“We found something called a command line wallet for monero,” Himonidis stated, describing it as a type of software program pockets. “You can’t find it with the Finder on the Mac. You need to go into a command line prompt to access this wallet — a Bash shell command on a Mac environment.”

Multiple investigators and attorneys informed CNBC that they’re at all times looking out for any kind of crypto — however notably privateness tokens. There can also be particular consideration paid to any type of {hardware} pockets or computing gadget, which might double as a type of “cold storage” for cryptocurrencies.

People who maintain their very own cryptocurrency can retailer it “hot,” “cold” or some mixture of the 2. A scorching pockets is related to the web and permits house owners comparatively quick access to their cash to allow them to spend their crypto. The trade-off for comfort is potential publicity to dangerous actors — and forensic investigators working for divorce attorneys.

An individual holds a cryptocurrency {hardware} pockets.

Geoffroy Van Der Hasselt | AFP | Getty Images

With chilly storage, the personal keys — or the passwords that allow the crypto to be moved out of the pockets — are saved on units, reminiscent of computer systems, that aren’t related to the web. Thumb drive-size units, reminiscent of a Trezor or Ledger, supply one other solution to safe crypto tokens chilly by safeguarding each the crypto itself and the keys to entry it.

Mark DiMichael, who has been within the forensic accounting discipline for greater than 14 years and is an authorized cryptocurrency forensic investigator, described one case to CNBC by which a divorcing couple had a stand-off over a password-protected Ledger gadget.

In the case, DiMichael stated, the husband had a Ledger after which the spouse discovered the gadget in the home and took it. “So the wife had the Ledger, but she didn’t know the pin number, or password. And the husband — he knew the pin number, but he didn’t have the Ledger.”

Neither may entry the funds with out the cooperation of the opposite.

DiMichael, who stated he has tracked down tens of millions of {dollars} value of cryptocurrency since he started tracing digital property in 2018, defined that when crypto is saved chilly, it might be tougher to grab however it’s nonetheless traceable.

“If they’re doing on-chain transactions and they move something to cold storage, it’s still visible on the blockchain,” he stated.

DiMichael informed CNBC that in a divorce case when you can no less than show that the crypto is there — or that it hasn’t been offered — that is normally ample for a decide. If a partner purchased 100 bitcoins on Coinbase, for instance, and later transferred the forex off an trade to a pockets, it is nonetheless sitting there and absolutely seen on the blockchain. A court docket can then order different cures to retrieve these funds, in response to DiMichael.

New York divorce legal professional Sandra Radna informed CNBC that proper initially of a case, when she serves the summons and grievance for a divorce, she additionally asks for a preservation of property — referred to as the “automatic orders” in New York. At this level, Radna stated, she singles out pc exhausting drives in her request, to make sure that nothing can be destroyed. This is essential since these units are what the forensic investigator makes use of to find out the place the property — each crypto and in any other case — went.

“They go through the hard drive of the computer to look for ticker symbols within emails, which is how they can see what purchases were made,” Radna stated.

Radna stated she additionally asks for data reminiscent of a partner’s “public keys,” which she described as being virtually like an account quantity on the blockchain.

Currently, a lot of the world runs on one thing referred to as uneven cryptography, by which people use a personal and public key pair to entry issues reminiscent of e-mail and crypto wallets. A non-public secret’s a safe code that grants the proprietor entry to their crypto holdings — whereas the general public secret’s a novel pockets tackle. With the general public key, it’s doable to discover a full historical past of each transaction made into or out of that pockets.

“If you have that information, you will be able to see every transaction that they did, and it’s something that the attorneys are able to get as part of discovery because it’s not giving a private number, a private key,” Radna stated.

Bill Callahan of the Blockchain Intelligence Group stated that with that pockets tackle, crypto hunters are in a position to inform the legal professional or the legal professional’s investigator that they need to go to a selected trade to request extra data.

“One of the things we’re looking for are the on- and off-ramps. We’re looking to see how the money came on to the blockchain, where it may be, and then where it’s off to,” Callahan stated. He stated the move of funds can even present whether or not one thing was purposely hidden by an obfuscation approach reminiscent of utilizing a crypto asset mixer.

These so-called mixers are designed to obscure trails of funds by mixing somebody’s tokens with a pool of different people’ property on the platform. They transcend conventional crypto platforms in additional concealing the identification of the individuals concerned in transactions.

“We can kind of track and trace the flow after the proceedings are over to see if something was purposely hidden,” Callahan stated. “The blockchain never forgets.”

In one case, Himonidis stated, he needed to monitor round $2.3 million that was emptied out of a Coinbase account inside just a few months of divorce proceedings commencing. The crypto cash hadn’t been cashed out to fiat however as a substitute moved as crypto to addresses outdoors Coinbase in a sequence of roughly 14 outbound transfers.

“All of it wound up in two or three different wallets on a foreign exchange — a place like Coinbase, but in a foreign country that does not operate in the U.S. and is not subject to the laws and jurisdiction in the United States,” Himonidis informed CNBC.

DiMichael stated he has run into comparable points with circumstances the place funds had been transferred to a worldwide Binance account, and he was, subsequently, unable to subpoena data because the funds had been in an untouchable jurisdiction.

Tracking property will get particularly sophisticated when buyers start to maneuver their tokens throughout blockchains.

DiMichael stated “chain hopping” — an individual switching from one blockchain to a different in a short time — is an more and more frequent approach used to throw off investigators.

Blockchains have their very own native tokens. With ethereum, for instance, the token is ether. Developers have constructed cross-chain bridges to let customers ship tokens from one chain to a different. Transfers of digital property between chains has helped to develop the crypto market by giving individuals extra methods to pay and transact. Cross-chain bridges are important to the event of the decentralized finance, or DeFi, area, which is crypto’s different to the banking system.

But in a divorce case these bridges make it troublesome for investigators to observe the path of tokens.

Take the crypto token polka dot, which is buying and selling at round $5.40 and has a market valuation of over $6.3 billion. Because the digital coin is by itself blockchain, when somebody needs to commerce it they should “wrap it” with a purpose to purchase and promote it on the ethereum blockchain, Himonidis informed CNBC. Wrapped tokens are pegged to the worth of the unique coin however are interoperable with different blockchains.

“If we need to start tracing stuff like that, it gets very complicated,” stated Himonidis. “When they do coin swaps, now we’re jumping — literally jumping — blockchains, trying to trace the funds. It was complicated enough before, and now, it’s gotten exponentially more complicated in just the last year or two.”

Himonidis stated he and his agency are in a position to observe funds throughout blockchains utilizing a device beforehand solely accessible to legislation enforcement, the Internal Revenue Service, and monetary establishments that want it for his or her know-your-customer and anti-money-laundering features.

But even with new search instruments, Himonidis described his work as a literal race to attempt to sustain with the newest in quickly evolving crypto tech.

“It lends itself very well to people who have figured out how it works and understand what’s going on there,” stated Himonidis. “It’s this constant arms race.”

DiMichael agrees, telling CNBC it was “inevitable” that these sorts of obfuscation methods would crop up given the amount of cash within the crypto ecosystem now, even within the midst of a down market.

“But it is still coming as a total shock to the so-called non-monied spouses,” DiMichael stated.

Many centralized exchanges reminiscent of Gemini supply clients the choice to stake their tokens with a purpose to earn yield on their digital property that will in any other case sit idle on the platform. With crypto staking, buyers usually vault their crypto property with a blockchain validator, which verifies the accuracy of transactions on the blockchain. Investors can obtain further crypto tokens as a reward for locking away these property.

In one in all his divorce circumstances, DiMichael stated, the husband disclosed the cryptocurrencies he owned, however he did not disclose the tokens that had been staked.

“The ones that he staked, he wasn’t really counting those in his numbers, so I uncovered that through the investigative process,” DiMichael stated. “Even though this cryptocurrency wasn’t in his wallet anymore, he still had rights to it.”

Valuing crypto property in divorce court docket

Even when each events in a divorce are completely above board on discovery, volatility within the crypto market can show to be a significant problem when attorneys attempt to worth a marital property.

NodeBaron, a 36-year-old vascular surgical engineer and veteran who requested to be recognized by his Twitter username, stated he liquidated his stake in dogecoin for round $5,000 throughout his divorce. Six months later, his holdings would have been value near $1 million.

“The cost to get a divorce was almost like a million-dollar decision,” he stated.

Divorce legal professional Alexandra Mussallem stated that as a result of California, the place her follow is predicated, is a community-property state, she typically advises her purchasers on whether or not to remain in a specific asset — that’s, to take half of a group asset in form versus looking for a liquidated worth.

“With volatile investments, the right strategy for a spouse trying to build a stable asset base will be to seek a cash buyout at market value on crypto holdings,” stated Mussallem, including that it’s a query of managing danger.

The partner with greater danger tolerance could also be desirous to money out their associate and retain the crypto asset, given the heavy fluctuations within the crypto market, she stated.

Burris, the Texas-based legal professional, stated that in her first crypto case, round 5 years in the past, the husband wished to purchase the spouse out of his crypto holdings — which finally proved to be a very good resolution for him, given the fast worth appreciation within the crypto market since 2020.

New York is an equitable distribution state, that means {that a} partner will get 50% of the marital property amassed through the marriage.

Radna, the New York divorce legal professional, informed CNBC that digital property might be taken in two methods.

“One way is to say, what is the value of that digital asset today, and we divide that up,” she stated, calling the method analogous to shares. “You can either take the shares of stock, or you can take the value of that.”

In an up market, Radna stated, spouses usually go for taking the worth of the crypto holdings.

Valuing and dividing a marital property can develop into particularly problematic when spouses diversify their crypto portfolio into metaverse properties and non-fungible tokens, or NFTs. Despite the NFT market collectively shedding practically $2 trillion since its peak in 2021, blue-chip sequence reminiscent of Bored Ape Yacht Club nonetheless have a ground worth of greater than $80,000.

“You have digital land as NFTs, you have digital artwork as NFTs, you have digital metaverse clothing in NFTs,” stated DiMichael, including that one in all his purchasers had offered $80 million value of NFTs.

DiMichael, who first spoke with CNBC in 2022, stated that if a partner has a few NFTs from a group just like the Bored Ape Yacht Club or Crypto Punks, it may add a pair hundred thousand {dollars} to the marital property.

“NFTs are really driving me nuts. How do I find the real expert to value the NFT, which is my obligation for a court of law?” stated Nutter, the Florida divorce legal professional, referring to the Daubert normal, a rule that governs the admissibility of skilled witness testimony in court docket. “It requires more peer reviews, articles, a lot more science and community acceptance, which is challenging when you have something particularly like an NFT.”

“NFTs are kind of new, and people know what they are, but to find somebody who has the level of expertise that could satisfy a court Daubert challenge and questioning I think is problematic for pretty much everybody,” she stated. “Doesn’t matter what side of the coin you’re on.”

Radna, who principally handles litigated divorces and has been practising for 30 years, stated she particularly appears to be like for digital actual property property within the metaverse when she requests discovery.

“You think it’s not real, but they make real income from it,” stated Radna. “They can get paid for someone to rent that digital real estate where they can have advertising and a billboard, but it would be in the metaverse.”

If a partner owns digital actual property and so they’re getting lease for it, that will be revenue and counted within the divorce, in response to Radna, who stated 20% of her caseload has concerned crypto in the previous couple of years.

“It’s a whole new world, and people should be aware of it,” she added.

Certified monetary planner and analyst Davon Barrett informed CNBC that with a conventional asset class, he can simply give a divorce settlement to Fidelity, for instance, and the corporate will care for the cut up by itself.

“But with cryptocurrency, it’s a newer space,” stated Barrett, the lead advisor at Francis Financial in New York. “It’s harder to get customer service on the phone at times, so splitting it becomes a little bit more difficult.”

The tax implications are one other main consideration when selecting the right way to divide crypto property.

The IRS treats cryptocurrencies like property, that means that every time you spend, trade or promote your tokens, you are logging a taxable occasion. There’s at all times a distinction between how a lot you paid to your crypto, which is the fee foundation, and the market worth on the time you spend it. That distinction can set off capital features taxes.

“There are people who bought bitcoin years ago, so their cost basis was $10,000,” Barrett stated.

He gave a hypothetical the place a shopper would doubtlessly be smarter to maintain $500,000 in money, versus bitcoin, in order that their partner is the one caught with the features.

“The government, they may not have gotten it in the past, but Uncle Sam is really good about getting his money,” Barrett stated.

“I think that you have your head in the sand if you don’t think that this is something that’s here to stay, even if during a down market,” Radna stated.

“Like any other asset, just like the stock market, there’s going to be ups and downs. I think the people that are interested in digital assets are going to continue to be interested in digital assets,” she stated. “When it’s a down market, that’s when you go shopping.”

Source: www.cnbc.com”