It’s easy, actually — however nonetheless revolutionary.

Berkshire Hathaway (BRK.A) – Get Free Report CEO Warren Buffett’s investing opinions are virtually scripture in relation to fashionable investing. Buffett’s investments made on behalf of shareholders have a terrific fame for incomes success.

Berkshire Hathaway vice chairman Charlie Munger can also be commemorated for his funding outlooks, so when the 2 of them again a technique, everybody quiets all the way down to pay attention.

Even now, within the wake of the Silicon Valley Bank collapse, Buffett’s stalwart views on the longer term are comforting traders in the course of the chaos. In his most up-to-date letter to shareholders, the monetary veteran put emphasis on the significance of admitting whenever you’re fallacious.

DON’T MISS: SVB Collapse Has Extreme Consequences For These Companies

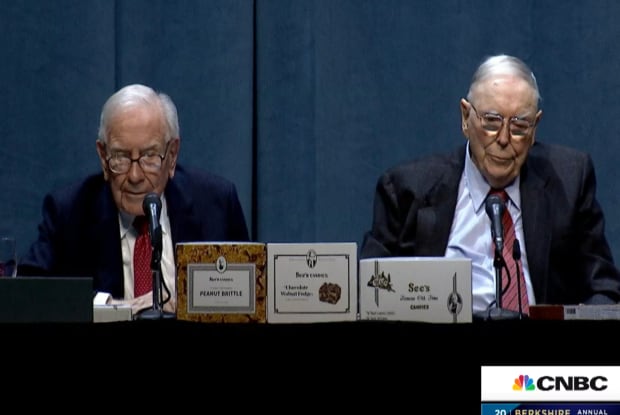

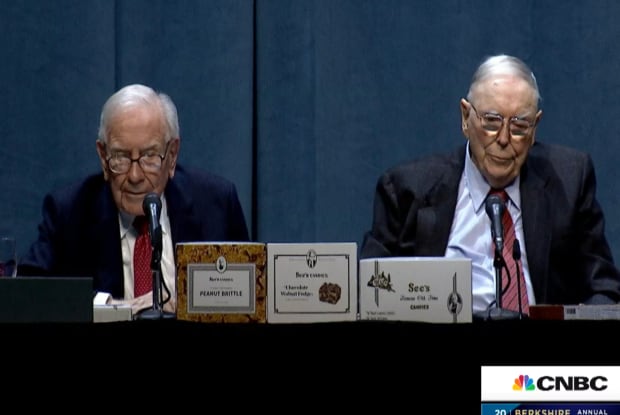

Image supply: Screen seize/CNBC

“Over the years, I have made many mistakes,” Buffett wrote. “Consequently, our extensive collection of businesses currently consists of a few enterprises that have truly extraordinary economics, many that enjoy very good economic characteristics, and a large group that are marginal.”

Buffett continued, admitting that not every investment was a winner.

“Along the way, other businesses in which I have invested have died, their products unwanted by the public,” he shared with readers. “In some cases, also, bad moves by me have been rescued by very large doses of luck.” The billionaire investor points to the “escapes from near-disasters at USAir and Salomon” to illustrate his mistakes.

“Our satisfactory results have been the product of about a dozen truly good decisions – that would be about one every five years.”

The level Buffett is making is not to tug him previous decisions by means of the mud, as identified in The Economic Times. The level is to confess whenever you’re wrong–a tactic that different traders not often take. Buffett and Munger each admit brazenly when hindsight reveals a greater path. Both males handed on investing within the early days of the tech business, they usually each admit that was a mistake. And in an effort to be taught out of your errors, you need to acknowledge them first.

Source: www.thestreet.com”