Growing fears Russia could change off provides of pure fuel to Europe have pushed UK wholesale costs to ranges final seen within the early days of the struggle in Ukraine, with a market professional telling Sky News there’s worse to come back.

The contract for next-month UK supply was greater than 12% larger at one stage on Wednesday after flows from the Nord Stream 1 pipeline, which offers greater than a 3rd of Russian fuel to the EU, have been reduce to twenty% of capability from 40%.

The transfer, blamed by state-owned Gazprom on upkeep delays, has exacerbated fears that the bloc’s reliance on Russian fuel is getting used as a weapon by the Kremlin in revenge for Western sanctions over the Ukraine invasion.

The Kremlin has cited sanctions-driven technical points with gear stopping Gazprom from exporting extra.

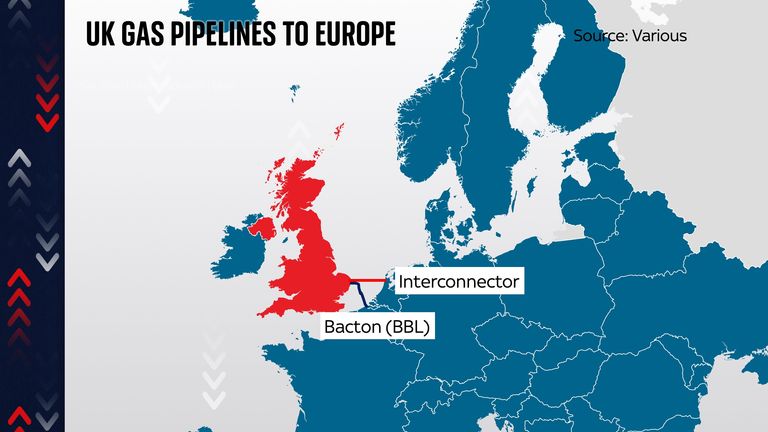

While Russian fuel solely accounts for 4% of UK provides historically, a scarcity of storage mixed with many different components together with steady North Sea output in the course of the heat months of low demand has allowed the nation to assist its neighbours on the continent by exporting fuel at report volumes.

Nevertheless, UK wholesale costs for August have been rising sharply for greater than every week and have been hovering just under 400p a therm – final seen in March – in risky buying and selling early on Wednesday from a determine nearer 360p the day past.

The principal North European worth was up by €26.18 to €222.50 per megawatt hour.

When measures of UK and European prices are in contrast, it reveals the UK wholesale worth was about 30% decrease than its continental counterpart.

The worth hole will quickly shut

Tom Marzec-Manser, head of fuel analytics at commodities specialist ICIS, stated of the distinction: “British gas prices remain at a discount with those on the continent… as Britain is oversupplied with LNG (liquified natural gas) arrivals and cannot export surplus volumes to the European mainland at quick enough rates.

“Britain solely has a small quantity of fuel storage capability, too, a lot of the arrival surplus can’t be saved in reserve for winter.”

He said the lack of storage meant there would be a price consequence ahead: “ICIS information present the fuel market anticipate the low cost held by British wholesale costs will evaporate as winter begins and demand rises.”

There were already signs of rising prices ahead as the UK wholesale price for October delivery rose 30% to 490p on Wednesday despite being far less exposed to the supply crunch.

Data shows European stocks at just 66% of capacity ahead of winter and the EU has responded with a voluntary plan for member states to curb gas use by 15% in a bid to prevent costly outages including factory shutdowns.

Low stocks following a cold end to the winter of 2020/2021 helped start the price spiral before it was elongated by Russia’s invasion of Ukraine and the resulting cuts to gas flows.

Data from Nord Stream 1 operators showed that volumes fell early on Tuesday and again on Wednesday.

Economists have warned that recession is inevitable in the event heavy users of Russian gas, including Europe’s largest economy Germany, have to take extraordinary measures to ration supplies.

Berlin accused the Russian government of a “energy play” by its administration of Nord Stream 1.

The fuel worth state of affairs, finally, threatens to exacerbate the value of residing disaster throughout Europe.

What it means for the UK

The Bank of England predicts that UK inflation will cross 11% within the coming months, however the newest worth shifts for fuel could power policymakers to ramp up their prediction after they subsequent meet in every week’s time.

That is as a result of the price of pure fuel has been the driving power behind will increase to vitality payments – for households and companies alike.

The inflation downside is made worse for shoppers when corporations cross on their very own larger vitality and gasoline payments down the provision chain, making items and providers costlier throughout the board.

The vitality worth cap is predicted by business consultants to hit a median £3,244 per yr from October after which cross £3,300 in January on the subsequent assessment.

The cap presently stands at a median £1,791.

MPs’ this week demanded the federal government elevate its £37bn value of residing assist package deal for households in anticipation of the worth surge to come back.

The massive query is whether or not the shock to payments will likely be even worse than anticipated.

The reply, for this winter, in all probability lies with Vladimir Putin on the Kremlin.

Source: information.sky.com”