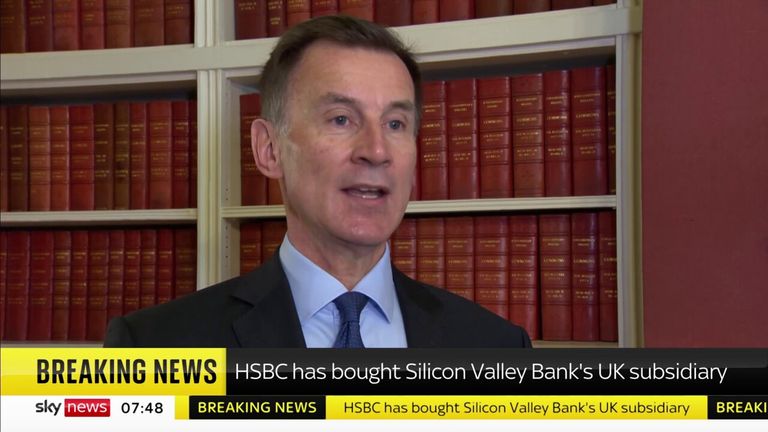

While there might be large aid at HSBC’s rescue of Silicon Valley Bank’s (SVB) UK arm, sparing the UK tech sector from a physique blow, this story has a protracted method to run.

The repercussions might be felt for a while, significantly within the United States, the place Silicon Valley Bank was the nation’s sixteenth largest lender and a mainstay of offering banking companies for the tech sector.

Already the knock-on results of what has occurred are being felt within the US greenback itself.

The buck has weakened towards different main currencies as a result of there’s a view available in the market that, with SVB’s collapse having raised broader issues concerning the general resilience of the banking sector, the US Federal Reserve goes to need to sluggish the tempo at which it has been elevating rates of interest.

That has additionally been proven within the violent rally within the worth of US authorities bonds (Treasuries) on Monday.

The market had been assuming the Fed would elevate its foremost coverage fee subsequent week by one other quarter level. Some market contributors, such because the influential economics workforce at Goldman Sachs, now anticipate no change.

That, in flip, has despatched shares of various main US lenders decrease, together with Bank of America and Wells Fargo, in addition to a bunch of smaller regional lenders.

These embody First Republic Bank, a small lender which revealed on Sunday night that it has acquired funding from each the Fed itself and likewise JP Morgan Chase, America’s greatest financial institution.

First Republic Bank’s shares fell by 71% in pre-market buying and selling whereas different regional lenders, together with Western Alliance Bancorp and PacWest Bancorp, have additionally seen their shares fall.

While the US and UK governments have acted rapidly to shore up confidence within the banking sectors, buyers will nonetheless be nervous concerning the profitability of the sector, significantly if rates of interest cease rising so quickly.

The repercussions are additionally being felt on this facet of the Atlantic, too, with market expectations for the extent to which the European Central Bank will be capable to elevate rates of interest this yr additionally moderating.

Accordingly, shares of some huge European lenders have fallen sharply together with the likes of Commerzbank, Germany’s second largest lender and Sabadell, the Spanish mother or father of TSB. In the UK, shares of all the large lenders are sharply decrease, too.

Read extra:

HSBC-SVB UK deal fails to initially reassure markets

UK department of financial institution purchased for simply £1 as taxpayer protected

US authorities step in to guard deposits

Even although fears about attainable contagion within the monetary companies sector have been largely put to mattress, there’ll nonetheless be different questions.

Chief amongst these might be for US monetary regulators.

This was the most important banking collapse because the world monetary disaster however there have been delicate variations from what occurred then. On that event, banks like Lehmans had steadiness sheets filled with securities that proved to be of an inferior high quality than was implied by the credit standing of these securities, for instance mortgage-backed securities that, as a substitute of being backed by top quality loans, have been really backed by sub-prime mortgages.

SVB couldn’t have been extra totally different. For a begin, on the face of it, it seemed to be nicely capitalised and worthwhile. It additionally didn’t look like behaving recklessly.

Normal banking apply sees banks take cash from depositors and lend it out to debtors at a better fee or deposit it in interest-bearing securities. However, within the case of SVB, it was taking deposits from its prospects at a a lot sooner fee than it may lend that cash out.

Accordingly, having taken in huge sums from its purchasers within the tech sector, it then reinvested most of these deposits in US Treasury bonds which, in idea, are among the many most secure monetary investments on this planet. This, in precept, is exactly the sort of prudent behaviour that monetary regulators around the globe would applaud and particularly within the wake of the monetary disaster.

In apply, although, it was a method that blew up when the Fed started elevating rates of interest in response to inflation.

US Treasuries have repriced over the last yr extra aggressively than they’ve achieved in a long time.

Take 2-year US Treasuries. The yield (which strikes in the other way to the worth) rocketed from 0.732% originally of 2022 to five.084% on Wednesday final week, a stage not seen since 2007, spelling hassle for anybody – like SVB – with an funding portfolio closely concentrated in such property. So regulators are going to be underneath stress to verify this doesn’t occur once more.

While lenders on each side of the Atlantic have been subjected to common stress exams because the world monetary disaster, these stress exams have tended to contain eventualities like recessions and housing market collapses, slightly than a sell-off in one of many world’s least dangerous monetary property.

It appears extremely possible that, in future, banks might be required to carry a much bigger portion of capital not in Treasuries however in money.

This will, after all, have the impact of decreasing their profitability.

There may also be implications for the way in which through which the tech sector and the enterprise capitalists who assist it function.

The former are going to return underneath higher stress from their buyers to think about extra deeply what, on the face of it, are thought of to be comparatively mundane points corresponding to money administration. Tech start-ups, slightly than being directed in the direction of a specialist lender like SVB, are additionally extra possible in future to gravitate again in the direction of extra conventional lenders – a chance which can nicely have knowledgeable HSBC’s determination to purchase SVB UK.

Among essentially the most attention-grabbing aspects of this saga has been the distinction within the approaches taken by the UK and US governments.

Here, the UK opted for a personal sector resolution in in search of to attempt to discover a purchaser for SVB UK, slightly than see the enterprise tipped into an insolvency course of. In the US, the federal government has adopted a public sector strategy, with the Federal Deposit Insurance Corporation successfully backstopping depositors. Joe Biden, the US president, approvingly retweeted a tweet from the New York Times this morning which used the time period ‘bail-out’.

However, this was solely a bailout for SVB’s depositors, as shareholders and bondholders in SVB have successfully been worn out.

And that, in its personal manner, is simply as Darwinian because the UK resolution.

As Bill Ackman, the famous US hedge fund supervisor, famous: “Our government did the right thing. This was not a bailout in any form. The people who screwed up will bear the consequences. The investors who didn’t adequately oversee their banks will be zeroed out and the bondholders will suffer a similar fate.

“Importantly, our authorities has despatched a message that depositors can belief the banking system. Without this confidence, we’re left with three or probably 4 too-big-to-fail banks the place the taxpayer is explicitly on the hook, and our nationwide system of neighborhood and regional banks is toast.”

Perhaps the most important lesson of all is that, in an age of smartphones and social media, even essentially the most strong of banks can discover themselves undermined. SVB’s issues started when some buyers received wind of a attainable fairness fund-raising.

Then, within the tight-knit world of the US tech sector, depositors started withdrawing their capital, amongst them Founders Fund, the enterprise capital fund co-founded by the influential investor Peter Thiel.

And that, in itself, is a big irony. Venture capital companies attempt to again portfolio firms over the very long run. SVB was trusted by them, accordingly, to assist their purchasers over the long run. However, in its hour of want, SVB discovered itself let down within the brief time period by the very buyers who it had apparently supported over the long run.

The VCs and their portfolio firms pulled their cash from SVB as a result of they’d misplaced belief within the financial institution.

In that sense, this was a financial institution run not so totally different from some other.

Source: information.sky.com”